Mtd is deducted in accordance with the income tax deduction from remuneration rules 1994 and included benefit in kindbik and value of. As of 6 April 2017 tax and national insurance savings for employers and employees for most salary sacrifice schemes have been removed.

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

Revisiting Scenario 1 where the benefits LHDN BIK Public Rulings 12122019 on the value of private use of the car and petrol provided is benefit-in-kind and taxable to Leong who is receiving the benefits as the car which is provided to the Leong is regarded to be used privately if.

. 9 Benefits In Kind Decimal 11 The total value of the benefits in kind provided by the employer excludes the value in sen. LHDN except for benefits listed in Paragraph 9. The Formula Method which uses this calculation.

Therefore if furniture is provided together with the accommodation the value of this benefit furniture is to be included as gross income from employment under paragraph 131b of the ITA. Benefits-in-kind eg motorcar and petrol driver gardener and more. It is worth noting that the discussion on the imposition of zakat on benefits in kind has not been.

Superceded by the Public Ruling No. 2017 budget speech finance bill 2016. There are two ways to determine the monetary thus taxable value of these benefits.

Value of asset Lifespan of asset Annual value of benefit. These also count towards part of your income. Hotel accommodation for employee or.

Benefits in Kind - LHDN was created by Chian Wei. 112019 12122019 - Refer Year 2019. Lower of 30 cash of remuneration or defined value of accommodation.

A further clarification on benefits-in-kind in the form of goods and services offered at discounted prices. Benefits in kind BIK include several things such as. Housing accommodation unfurnished for employee or service director.

Based on formula or prescribed value method. Private treatment company car gym membership interest-free loan travel expenses and living accommodation. Hi Kap-Chew Would ask for your favourite how to set the benefits in kind for the Director in payroll.

ZAHRI HAMAT School of Social Sciences Universiti Sains Malaysia. All benefit arrangements in place before April 2017 will be protected for up to 1 year while cars accommodation and school fees arrangements will be protected until 2021. VALUE OF BIK PER YEAR.

Kind received by an employee are taxable by Inland Revenue Board of Malaysia LHDN except for benefits listed in Paragraph 9. LEMBAGA HASIL DALAM NEGERI MALAYSIA LIVING ACCOMMODATION. Motorcar and other related benefits 711.

2012 return form of employer form lembaga hasil dalam negeri malaysia e this. Where a motorcar is provided the benefit to be assessed is the. Tax treatment on the benefit received on the employee as follows-.

22 However there are certain benefits-in-kind which are either exempted from tax or are regarded as not taxable. Certain benefits areexempted from tax. BIK refers to benefits given to employees which cannot be convertible into money such as motorcar and household.

And in certain cases one should also be aware of the exemptions granted. RM420080 or RM420010 is reported as 4200 10 Value Of Living Accommodation Decimal 11 The total value of the living accommodation benefit provided by the employer in Malaysia excludes the value in sen. Please Log in or Create an account to join the conversation.

Telephone including mobile phone i Hardware - fully exempt ii Bills - fully exempt. BIK refers to benefits given to employees which cannot be convertible into money such as motorcar and household furnishings apparatus and appliances. Think of these as perks but ones that cannot be directly converted to cash.

Bik item descriptions if any will show. Motor cars provided by employers are taxable benefit in kind. These benefits-in-kind are mentioned in paragraphs 43 and 44 of the Public Ruling No.

6 months 22 hours ago 4098. Particular Benefit In Kind 71. The basis of computing the benefit whether the formula method or the prescribed value method must be consistently applied throughout the period of the provision of the benefit.

1st December 2017 1 BENEFIT IN KIND. Superceded by Public Ruling No122017 29122017 - Refer Year 2017. Lembaga Hasil Dalam Negeri Malaysia.

Recreational club individual membership subscription paid or reimbursed by employer. SHOULD IT BE EXEMPTED FROM ZAKAT. Several tax rules are governing how those benefits are valued for tax purposes and income tax declaration.

22004 issued on 8 November 2004. Accommodation without taking into account the value of other benefits or amenities provided. According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year.

Tis The Season To File Your Taxes Again So We Thought We D Help You Out With E Filing Rojakdaily

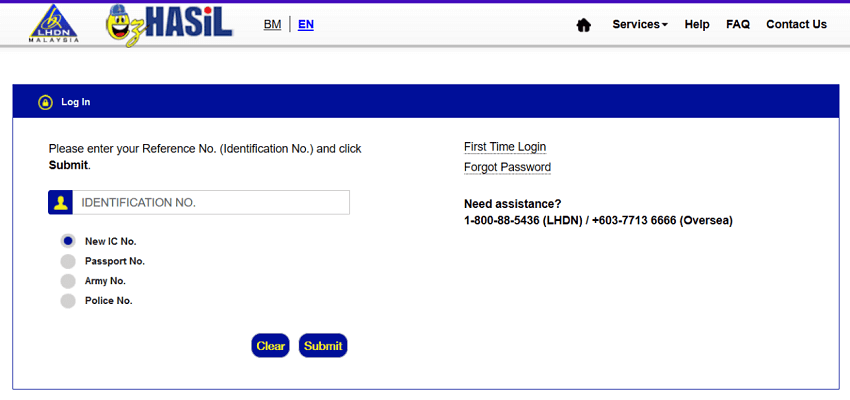

Ctos Lhdn E Filing Guide For Clueless Employees

Starting Another Business And Why Everyone Must Try Suyin Ong

Ctos Lhdn E Filing Guide For Clueless Employees

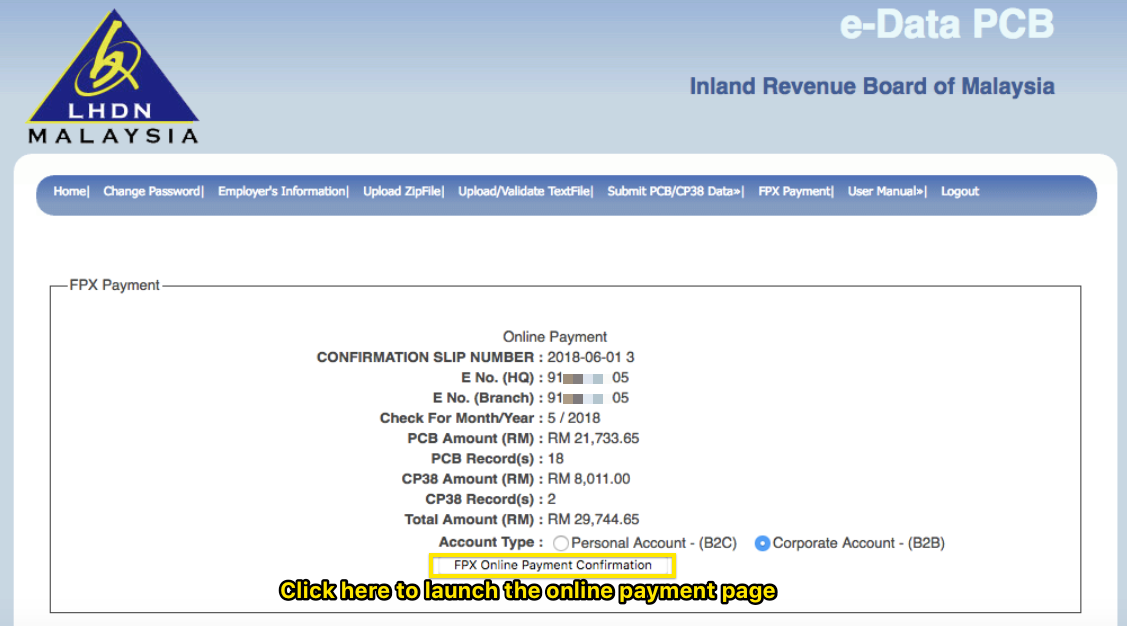

Employer S Tax Reporting Subang Pages 51 100 Flip Pdf Download Fliphtml5

Tax On Religious Organisations Applies Across The Board

Spesifikasi Kaedah Pengiraan Berkomputer Pcb 2022 Lembaga Hasil Dalam Negeri Malaysia Amendment Studocu

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

Ctos Lhdn E Filing Guide For Clueless Employees

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Lhdn Malaysia Bloggers And Influencers To Pay Tax Starting 2016 Rebecca Saw

Ctos Lhdn E Filing Guide For Clueless Employees

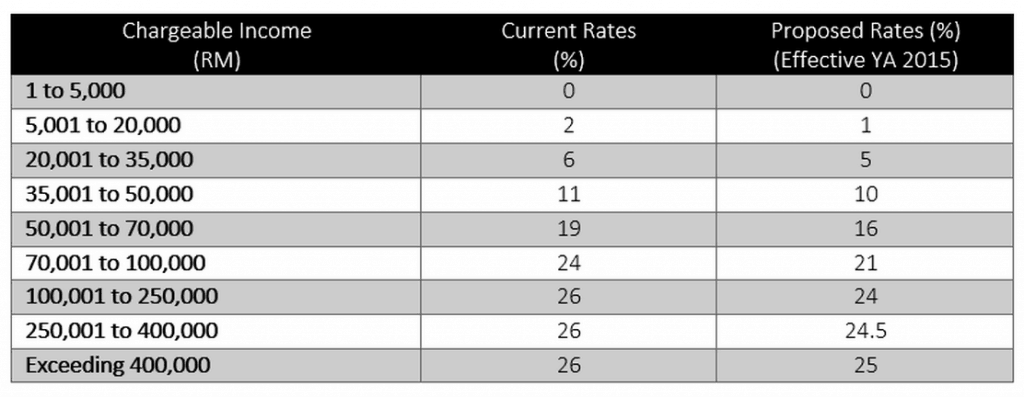

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Everything You Need To Know About Running Payroll In Malaysia

Lhdn Irb Personal Income Tax Relief 2020